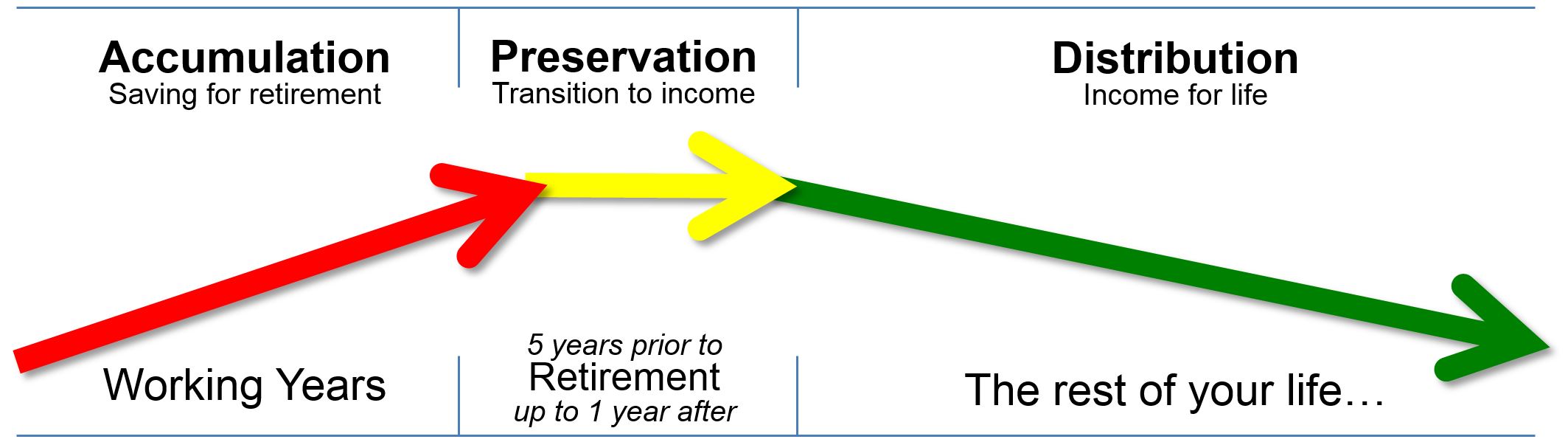

Many experts agree, there are really just three phases of your investment life;

Accumulation, Preservation

and Distribution

The first phase, Accumulation

These are the years when you save, take risks and pay off debt in preparation for the next phase of your investment life.In accumulation you are working for a paycheck. Each check you earn, you save a designated amount, for example in a 401K, 403b, and IRA’s. In this accumulation phase you can take chances with possible more risky investment vehicles as you are still working and can replace any funds you lose. The purpose during these years is long term growth.

Phase 2, Preservation

The Preservation phase usually starts about 5 years before you will retire. This is when you start considering more conservative strategies for your life long savings and investments. By migrating your assets into safer vehicles with little or no risk to principle, you make planning for the day you retire a reality. Safer vehicles can insulate your portfolio from abrupt market corrections.

Phase 3, Distribution

Distribution is a whole new ball game. During accumulation you could afford to lose some money on risky investment vehicles because you were working and could afford to replace funds with paychecks as you earned money. Distribution is all about making your life long savings provide income as long as you are around. You are now tasking your retirement savings with two important functions; income for your lifetime and maintaining principle as well. These are completely different tasks from long term accumulation.

The challenge during distribution is that during market down years the market is taking principal and you are competing by also taking principal to live on. This makes it almost impossible to get your principal back as two things are competing for your money; the down market and you.

“This is a huge change from what you are used to and some folks resist and wait too long to realize their mistake and lose precious principal on investment vehicles not designed for income.” In your distribution phase, it's all about your spendable income, otherwise called cash flow.”

123EasyRetirementIncomePlanning.com is privately owned and operated by American Retirement Advisors.

We are not a government resource nor do we provide legal or tax advice. We make understanding Retirement Income Planning 123 Easy.